30+ How much mortgage could we get

Keep in mind that there may be lender fees and other costs that youll pay to refinance. Do you want to.

30 Maps Of America That Will Make You Question Everything You Know About The Usa Opossumsauce America Map Usa Map Question Everything

Using our Mortgage Calculator can take.

. The Solar Energy Industries Associations 2008 US. Buying in 4 to 5 Months. For a 250000 loan that could mean a difference of more than 100000.

To get started with either approval option apply now on Rocket Mortgage. Because youll pay thousands more in interest if you go with a 30-year mortgage. Well do a full verification of your income assets and credit so sellers can be certain you wont run into financing issues.

We are an independent advertising-supported comparison service. Solar energy deployment increased at a record pace in the United States and throughout the world in 2008 according to industry reports. This formula can help you crunch the numbers to see how much house you can afford.

In a typical 30-year mortgage about half the total interest you pay will accumulate in the first 10 years of your loan. 15 year fixed mortgage rates. 30 year fixed mortgage rates.

Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score. For example we estimate that less than 30 percent of a registered nurse. Your credit report card shows your ratio credit card debt credit limit and how different factors affect your score.

Mortgage interest rates are always changing and there are a lot of factors that. You could access 30 more of the mortgage market with a broker on your side Get Started with an OMA-Expert to find out how much this could save you and unlock more deals. Our TravelMoneyMax tool compares 30 bureaux to max your.

Speak to a mortgage affordability specialist. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow. Use too much and your score goes down.

Check rates today to learn more about the latest 30-year mortgage rates. 1681276 for surprisingly efficient and user-friendly and free comparison of refinancing rates on both home and. Find out how much you could borrow for a mortgage compare rates and calculate monthly costs using our mortgage calculator.

The earlier into the loan you do this the more of an impact it will have. In 2019 78 of borrowers refinanced from a 30-year fixed-rate mortgage into the same loan type according to Freddie Mac. Another 14 went from a 30-year to a 15-year fixed.

We often link to other websites but we cant be responsible for their content. Get your debt usage now. And 7 went from a 30.

In this post weve tracked rates for 30-year fixed-rate mortgages. Based on a percentage of the sale price directly impacts your monthly mortgage payment based on a 30-year mortgage at a fixed rate of 4241 APR. Use too much and your score goes down.

How you use credit affects your credit score. Loan principal 200000. Get your debt usage now.

The average interest rate for the most popular 30-year fixed mortgage is 548 according to data from SP Global. Heres how it works. Loan types mortgage basics and refinancing.

Alternatively if you dont have your mortgage account number to hand get an idea of what mortgages we could offer you and how much the monthly costs would be by answering a few questions. Were not there yet but were close Orr told The RBNZ on Wednesday again lifted the OCR aggressively from 25 to 3 per cent in line with expectations and forecast it peaking at around 4 per. How we calculate how much house you can afford.

A lender may structure your 300000 30-year fixed-rate loan with choices including paying zero points paying 1 point or paying 2 or more points at closing. If you still owe 200000 on your mortgage you could take about 40000 in cash out of your home in a cash-out refinancing. For example we estimate that mortgage brokers spend as much as 90 percent of their time processing applications.

Here is an example of how discount points can reduce costs on a 200000 30-year fixed-rate mortgage. Fears of inflation continue to affect 30-year fixed mortgage rates which rose to 584 percent in Bankrates weekly survey of big lenders. It is advisable to start the mortgage application process as soon as possible to shorten this process.

Typically you can get an APR reduction of 025 per point on fixed-rate mortgages. How We Get Paid. For example a 30-year fixed mortgage would have 360 payments 30x12360.

Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score. Your credit utilization ratio or how much of your credit limit you use makes up 30 of your credit score. The SEIA report tallies all types of solar energy.

But 15-year fixed-rate mortgages tend to have even lower borrowing rates. In the usual market it takes an average of 30 days to get a mortgage. See how much your monthly payment could be and find homes that fit your budget.

Weve broken down some bullets of things to consider when deciding whether to pay off your mortgage early. An MMM-Recommended Bonus as of August 2021. But note that it.

If there are problems with your application getting your loan approved could take much longer. Apply And Check. Solar energy capacity increased by 17 in 2007 reaching the total equivalent of 8775 megawatts MW.

How you use credit affects your credit score. We also offer calculators to. Buying in 2 to 3 Months.

Buying in 30 Days. Putting in place more sophisticated verification processes for documents and credit applications could reduce that proportion to just more than 60 percent. Solar Industry Year in Review found that US.

For example if you realize you have 3000 left over at the end of each month decide how much of that could be allocated toward a mortgage. With a 15-year mortgage youd have a higher. A 71 ARM offers a fixed rate for the first seven years.

Find and compare 30-year mortgage rates and choose your preferred lender. To get one youll need to apply with Rocket Mortgage and then contact a Home Loan Expert. A hybrid loan such as a 71 adjustable-rate mortgage ARM could enable you to borrow more than you would with a 30-year fixed-rate loan.

We guarantee to get your mortgage approved where others cant - or well give you 100 Get Started Find Out More. A 15-year loan does come with a higher monthly payment so you may need to adjust your home-buying budget to get your mortgage payment down to 25 or less of your monthly income. Alternatively you could buy a more affordable house.

Scripts To 30 Loan Documents For Loan Signing Agents Etsy Loan Signing Loan Signing Agent Notary Signing Agent

Are You Worried About Rising Interest Rates Tuesdaytip Mortgage Getthathouse Interest Rates Mortgage Great Expectations

Mortgage Broker Facebook Ads Case Study 131 New Consultations Mortgage Brokers Case Study Finance Goals

Save 7000 In A Year With Just 5 A Week Realistic Money Saving Challenge Daily Finan Saving Money Budget 52 Week Money Saving Challenge Money Saving Plan

This 26 Week Money Saving Challenge Is The Best I M So Glad I Found This Amazing Challenge To Help Inspire And Motivate Me To Save Money This Year I Ll Be Abl

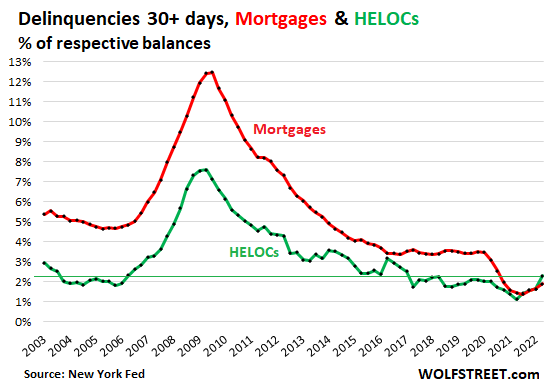

Trip Back To Reality Starts Q2 Mortgages Helocs Delinquencies And Foreclosures Seeking Alpha

Scripts To 30 Loan Documents For Loan Signing Agents Etsy Loan Signing Agent Loan Signing Notary

50 30 20 Budget Rule Free Budget Spreadsheet Healthy Wealthy Skinny Money Management Advice Budgeting Money Saving Money Budget

Simple 52 Week Money Saving Challenges Save Money Fast Radical Fire Saving Money Budget 52 Week Money Saving Challenge Money Saving Challenge

Scripts To 30 Loan Documents For Loan Signing Agents Etsy Loan Signing Agent Loan Signing Notary Signing Agent

Average 401 K Account Balance By Age Vs Recommended Balances For A Comfortable R Retirement Planning Finance Average Retirement Savings Saving For Retirement

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Do You Think All Homeowners Must Have A 20 Down Payment To Purchase A Home Luckily Mortgage Brokers Have S Real Estate Tips Back To Basics Home Ownership

5 Tips To Save A Lot Of Money Fast 1 000 In A Month Challenge Saving Money Chart Money Saving Strategies Saving Money Budget

Savings Challenge 1000 In 30 Days Challenge Days S1000 Savings Money Saving Plan Money Saving Strategies Saving Money Chart

How Would The Federal Tapering Affect Me Economy Infographic Mortgage Interest Rates Mortgage Payoff

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go